Ongoing retirement saving by Chapter 13 debtors has been a touchy subject since the means test became a part of the bankruptcy scene.

The means test was intended to squeeze every available dollar from consumer debtors. It works by limiting the expenses that can be deducted from income in figuring what a debtor can/must pay his existing creditors.

Retirement savings accounts have been broadly protected from the reach of Chapter 7 trustees and excluded or exempted in the asset analysis in Chapter 13.

But courts have been split over whether debtors are permitted deduct as a reasonably necessary expense their ongoing contributions to voluntary retirement schemes while in Chapter 13.

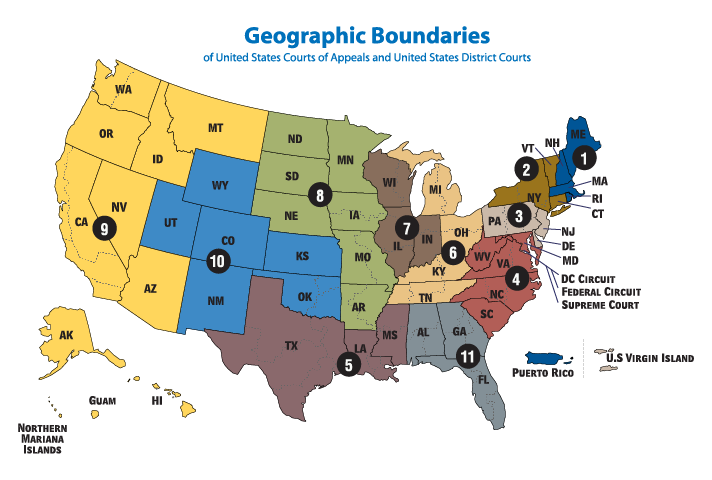

So, I’m cheering the 6th Circuit’s decision in Davis which held that monies withheld by a debtor’s employer to fund her 401(k) plan were an allowable deduction from income under the means test.

Ongoing 401(k) contributions allowed

The Davis decision effectively allows the debtor to reduce the amount the means test formula would require her to pay to her creditors by the amount of her 401(k) contributions.

The court described its ruling as narrow: it applied to contributions withheld by the debtor’s employer from her wages during the means test look-back period of six months.

Only by virtue of the provisions of Section 541(b)(7) that reference sums “withheld by an employer” were the contributions deductible in calculating “current monthly income”. The self employed or those whose contributions to retirement savings took another form are not protected like Ms. Davis.

In deciding that Ms. Davis could make ongoing 401(k) contributions, the appeals court had to wade through more sloppy drafting of the bankruptcy “reform” act of 2005. The drafters inserted this protection for ongoing contributions to retirement in a section that deals with property of the estate, rather than with the means test. The Davis decision decided that the judicial canon that says “every word matters” trumped the location of the text in the Bankruptcy Code.

Californians still barred from savings

Sad to report, but the retirement-friendly Davis decision comes from the 6th Circuit, not the 9th Circuit which includes California.

The 9th Circuit BAP held in Parks, 475 B.R. 703 (B.A.P. 9th Cir. 2012) that a Chapter 13 debtor could not deduct any voluntary retirement contributions in calculating what debtors pay in Chapter 13.

While it’s unclear the extent to which BAP decisions bind bankrutpcy courts in its circuit, as a practical matter, it will take an appeal to the 9th Circuit or legislation to assure Californians filing bankruptcy that they can continue to make provisions for their old age.

Retirement savings are necessary

I’ve long advocated for treating retirement savings as a necessary expense for purposes of both the means test and the debtor’s projected budget.

It is ludicrous to contend that individuals don’t have to make regular and meaningful contributions to their retirement accounts to enjoy a stable retirement.

And by mandating that savings are not permitted in Chapter 13, we condition debtors to spending every penny they make either for current living expenses or plan payments to deal with past debts. We forfeit the opportunity to habituate debtors to looking at their needs beyond the upcoming month.

Planning to file bankruptcy

Too often, individuals find themselves filing bankruptcy with little or no forethought. But if you see a bankruptcy in your future, and have the opportunity to have 401(k) contributions deducted from your paycheck, do it.