I coined a new rule about asset protection schemes after meeting with a bankruptcy prospect:

If the asset protection plan is too complicated for the owner to explain, it probably won’t stand up to challenge.

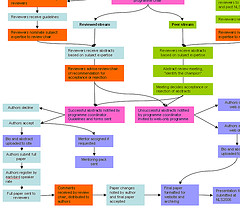

This man had paid an attorney a fistful of money to create LLC’s and limited partnerships, each of which held fractional interests in the other entities. Some pieces of real estate were owned outright by one entity or another; others were held jointly. One LLC was the general partner in another entity.

The client came with a chart, with arrows running back and forth. He couldn’t explain how it worked, or why it was structured that way, other than to make it difficult to reach his wealth.

But it came down to this: if there is no explicable business reason for this arrangement, it probably represents a scheme to hinder, delay, and defraud creditors. One a bankruptcy trustee could penetrate.

What fraud?

One of the hardest concepts of debtor/creditor law for the public to grasp is that of fraudulent transfers. Here’s the rule: you cannot legally transfer property for less than its present value in order to keep the asset from creditors.

Put another way: you can’t give your assets away to keep them from creditors.

At law, there are two kinds of fraudulent transfers: ones with actual intent to hinder creditors, and ones that are constructively fraudulent.

A constructively fraudulent transfer is innocent in intent but has the same effect of putting money where creditors can’t easily reach it.

A gift or a sale for less than fair value are constructively fraudulent.

And the rule against fraudulent transfers applies under state law as well as in bankruptcy.

Charity run amok

Even the most innocent gifts to charitable entitles can be fraudulent transfers if a creditor then holding a claim against the donor is prejudiced by the gift.

When I represented Chapter 7 trustees, I once had to retrieve an art work given by the debtor to the Easter Seals Society. On the face of it, the debtor was a model of benevolence: he’d made a stunning gift and gotten nothing in return.

The real story was far different.

The debtor hadn’t disclosed the jade carving in question in his bankruptcy schedules. Then soon after the bankruptcy, he got his picture on the front page of the local paper, donating the multi thousand dollar piece to charity.

The bankruptcy trustee confronted the charity with the news that it was the recipient of a fraudulent transfer.

The story got weirder still when the trustee tried to auction the carving off. We found the piece was a fake, worth not thousands, but only hundreds of dollars.

The debtor was lucky to escape with his discharge.

Unintended consequences of gift

Bankruptcy debtors who make fraudulent transfers expose the recipient to suit by the bankruptcy trustee.

If the charity had not voluntarily returned the carving, the trustee would have sue them to get it back.

The trustee has the power at law to recover transfers that are either actually or constructively fraudulent.

Not only does the Bankruptcy Code have a fraudulent transfer provision, but the trustee gets whatever powers a creditor in the state has to recover fraudulent transfers. In California, the look back period is four years.

Bankruptcy discharge at risk

Large scale, intentional efforts to put assets into the hands of others can result in the denial of the debtor’s discharge. One of the grounds to deny a person a discharge in bankruptcy is attempts to hinder, delay or defraud creditors.

The tangle of entities and fractional ownerships that my client laid out for me would have resulted in no discharge.

If a pattern of ownership has no purpose other than to make it hard on your creditors to reach your assets, it is unlikely to survive a bankruptcy challenge.

Related posts on legitimate asset protection

Uncle Sam Does Asset Protection

What Can I Keep If I File Bankruptcy

Image courtesy of Fiona Bradley