I miss Maurice Sendak, the late author of children’s books.

What does a book about a naughty child who adventures in a nighttime land of monsters have to do with being scared of bankruptcy?

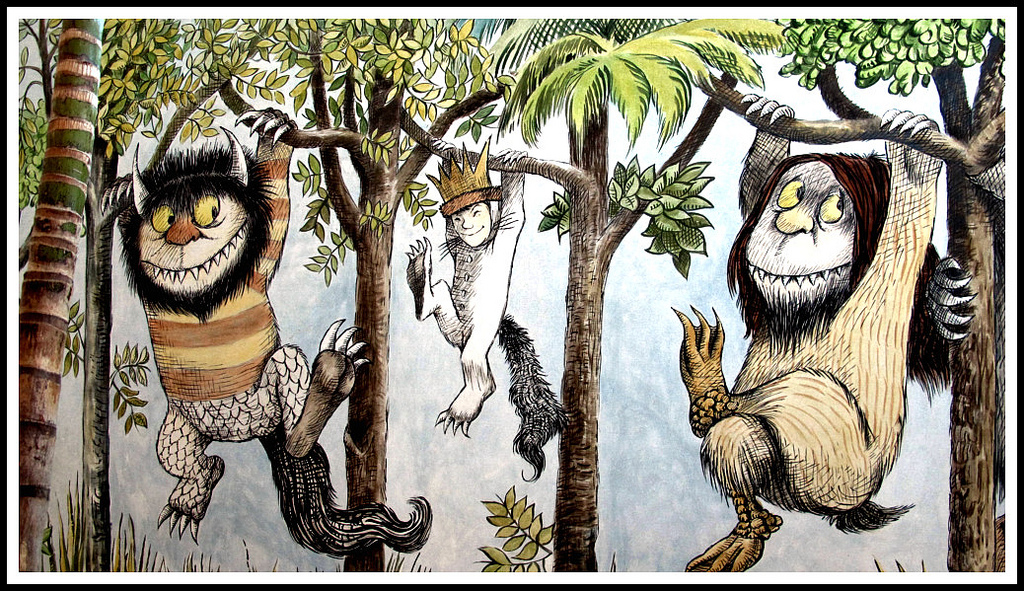

The last image in his signature book, Where The Wild Things Are, is my touchpiece for clients afraid to file bankruptcy.

Do you remember it?

When you get to the last page, and Max is back from his night time excursion with the wild things, safe in his own bed, you discover that the “monster” who loomed large and threatening was the size of a dust bunnie, living under his bed.

In other words, the monsters were all blown out of proportion.

Instead of being three times as big as Max was and vicious to boot, they were insignificant.

Which is a long way of saying that my clients let their imaginations run away with them.

Most fears of bankruptcy are invented

My clients create mental worlds of horrors that happen when you file bankruptcy. Such as:

- “they” come to your house and take everything you own

- you can’t keep your house if you file bankruptcy

- you have to explain to a judge why you deserve bankruptcy relief

- you’ll never get credit again, ever

- your name and bankruptcy filing is published in the paper

- you can’t discharge credit cards, medical bills, taxes, you name it

Each of these horrors are made up.

People who are stressed and fearful take a little bit of truth about bankruptcy, or some of the bad information out there, and blow it up til they are so scared of the unknown they’d rather continue in the world of financial hurt they presently occupy.

It’s unfortunate that my clients can’t make as much money from their imaginations as Sendak did.

But the truth is that when you have good information about how bankruptcy really works, the horrors are mostly made up. The relief that is available is real and reassuring.

Most of the pain in bankruptcy is self inflicted.

You can beat yourself up about the need for a fresh start as much as you choose. But it doesn’t have to be. There’s no reason to be scared of bankruptcy.

More

How money worries bleed into the rest of life

Who cares about your spending before bankruptcy

Do you lose everything in bankruptcy

Bankruptcy’s credit hit is short lived

Image courtesy of geraldbrazell

Bravo. That is the best image, one that all clients immediately recognize. I think I may begin explaining to my clients this way. Thank you!

Wow, this was so encouraging a few weeks ago when I was dreading the whole process, thank you for it! Unfortunately, I hired a cut rate attorney who is not up on the law on and he is terrorizing me with possible happenings, so I cannot eat or sleep. Be sure to advise people to get a referral from somewhere or otherwise they could have medical bills from heart palpitations. Since you don’t want to tell anybody you know about it, what is the best way to find someone calm, competent and human? It’s too late for me, unless mine cuts and runs, which I am hoping he will do! Thanks!

NACBA offers a Find A Lawyer feature. Many states have programs that certify bankruptcy specialists. Here’s a link to the California specialist search. Cathy