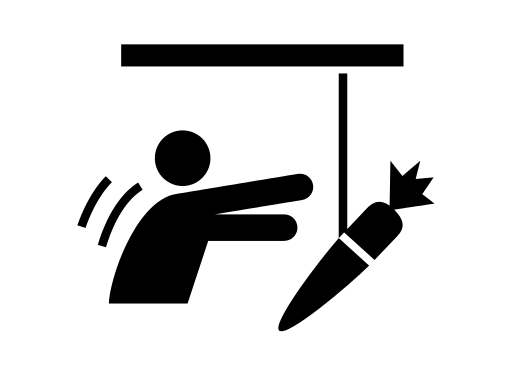

Debt settlement is often dangled in front of the financially challenged as an alternative to bankruptcy.

Sounds good: making a deal with your creditors has enormous appeal when you can’t pay everything that you owe.

And debt settlement companies count on it.

The pitch for “settling your debts” touches a nerve. Almost everyone WANTS to pay their debts.

But the truth is : Debt settlement companies rarely deliver what they promise.

Their pitch shouts that debt settlement is superior to bankruptcy.

It just ain’t so.

All too often, the client of the debt settlement company is exposed to continuing collection calls, lawsuits, plumeting credit scores, and garnishments while the company is attempting to settle the debt.

And in the end, many dollars later, debt settlement delivers neither a debt free life nor an undamaged credit report.

The appeal of debt settlement

What is it that makes a chancy, drawn out, expensive relationship with one of these debt settlement companies seem attractive to the financially overwhelmed?

I’d suggest:

- Enrollment appears to offload the problem on someone working for you

- High profile media types like Suze Orman and Dave Ramsey badmouth bankruptcy

- Promoters suggest that there is a “secret” to settling your debt for pennies on the dollar

- Paying some part of debt is morally satisfying

As long as the public buys the idea that bankruptcy is akin to leprosy, those who, for a fee, offer the secret, non bankruptcy solution get rich.

Settlement company gets theirs first

The truth is that most debt settlement companies get their money upfront. The first several months of payments don’t go to creditors or to building a settlement kitty, they go to the debt settlement company.

When the consumer figures out that paying the debt settlement people for months on end has not resolved any of the life-sapping incidents that come with being in debt: collection calls, law suits, levies, the debt settlement folks can move on to the next troubled consumer, with money in their pocket.

Debt settlement trashes credit scores

Debt settlement imagines making deals with your creditors over time, with the money you are paying the company, rather than your creditors.

Creditors don’t have to participate in debt settlement.

They certainly don’t stop reporting your lack of payment to the credit bureaus.

The longer you participate, the more the credit negatives pile up.

Bankruptcy delivers lasting relief

By contrast, bankruptcy is available for a flat filing fee of around $300 to the court, plus attorneys fees.

It is instantly effective to stop collections.

Creditors can’t opt out, like they can with debt settlement. All creditors are bound by the automatic stay and ultimately by the discharge.

And, the rules are enforced by a judge, with powers of sanctions and even incarceration.

The cherry on the top is that bankruptcy doesn’t generate cancellation of debt income issues. like debt settlement does. By law, debt cancelled in bankruptcy isn’t taxable income.

The long-term tax advantage for homeowners in bankruptcy over debt settlement

Bankruptcy bashes debt, for certain and for all time.

More

Pay off credit cards with no interest

Make no changes til you see a bankruptcy lawyer

What to ask a bankruptcy lawyer before signing up

Image courtesy of derekbruff.