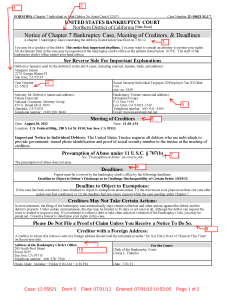

You’re looking at bankruptcy official form B9.

You’re looking at bankruptcy official form B9.

It arrived in your mail because someone has filed bankruptcy and listed you as a creditor on the schedules of a newly filed bankruptcy case.

Most likely, the debtor owes you money or you have an open claim of some sort against the bankrupt.

Your rights against the debtor have just changed.

Bankruptcy law, federal law, is now prepared to upend the debtor/creditor relationship.

You need to find all the information crammed into this single page so you can determine what, if anything, to do next. (Double click the image and you’ll get an enlarged version; hit the back arrow to come back here.)

1. Who’s filed bankruptcy?

The name of the person who filed the bankruptcy case and their mailing address is number 1 on our notice. Any fictitious business names or prior names would appear here as well.

2. Bankruptcy chapter selected

This notice tells us the debtor filed Chapter 7. Other possibilities are Chapter 11 and Chapter 13.

3. Date case commenced

The filing date of the case governs what claims and what assets are affected by the case. The automatic stay preventing collection action comes into force at the date and time the case was filed.

4. Bankruptcy case number

The leading number is the year the case was filed. The first number after the dash is the division within the federal district in which the case was filed.

5. Trustee appointed

Since this case is a Chapter 7, a trustee was appointed. His contact information is shown. In Chapter 11, the debtor usually assumes the duties of a trustee.

6. First meeting of creditors

You are invited to attend the first meeting of creditors at the date and time set out. Attendance is optional. If you go, you will get about 5 minutes to ask questions related to the bankruptcy case of the debtor, under oath.

7. Presumption of abuse

This language relates to the means test. In this case, the debtor’s income and means test expenses don’t trigger a presumption that the bankruptcy case is an abuse of Chapter 7.

8. Deadlines

If you want to challenge whether your claim is legally dischargeable or whether the debtor is entitled to a discharge at all, you must file that challenge by the date set out here. It’s a relatively short period, so heads up.

9. Getting paid

This is where the deadline to file a proof of claim is found. Only creditors who file a written claim will be paid in a bankruptcy case. In this case, it appears that there are no assets available to pay creditors. If assets are discovered, the court will give notice of the claims filing deadline. Here’s form_b410 for filing a claim.

10. Where’s the court

The clerk of the bankruptcy court and the clerk’s contact information is set out here.

What to do

The only thing that you must do upon receiving notice of a bankruptcy filing is stop:

The only thing that you must do upon receiving notice of a bankruptcy filing is stop:

- stop sending bills

- stop making collection calls

- stop any lawsuits filed

Whether you need or want to attend the first meeting of creditors or challenge the discharge of your debt depend on the facts of the case, including the amount of money at issue.

Usually, filing a proof of claim doesn’t require a lawyer. If you have questions or concerns beyond filing a claim, you may want to seek advice from a bankruptcy lawyer.