Your bankruptcy discharge is more than a piece of paper. It’s a federal court order prohibiting action to collect the discharged debt from you.

And it has teeth.

When creditors ignore a federal court order, it has unpleasant consequences. Or should have consequences.

So, my call to debtors is to stop being prey to unscrupulous debt collectors.

Bite back.

Discharge binds all creditors

All creditors who got notice of your bankruptcy are subject to the discharge injunction, with a few exceptions.

That’s why it’s so important to list everyone who thinks you owe them money in your bankruptcy schedules. Getting your schedules right.

The discharge is a public record, retrievable on PACER by anyone who is interested.

In short, there is no excuse for the creditor (or anyone who bought the debt from your creditor) to attempt collection of debts predating your bankruptcy.

And creditors who try to collect have effectively given you the right to sue them at their expense.

Here’s hoping that more debtors harassed by creditors after their bankruptcy will march into court for enforcement of their right to a fresh start.

When collector calls after bankruptcy

Whether it’s a debt buyer or the original creditor, it seems to be inevitable that you will encounter a collector after your bankruptcy case is over.

When that happens, make sure you tell the collector about your bankruptcy discharge. To have a legal remedy for the violation of the discharge, you will need to prove that the collector knows about the discharge.

- Tell them.

- Make notes that you’ve told them.

- Write them.

- Keep a copy of your letter.

They’ve had their one cost-free mistake. The next contact will cost them.

The debt buyer can’t hide behind the fact that it wasn’t the listed creditor in your schedules. If the debt buyer bought a discharged debt, he’s gotten nothing of value.

But again, you need to point out to the collector that the debt is gone by reason of the bankruptcy discharge.

Any further collection after learning of the bankruptcy spells trouble for the collector.

Suing to enforce the discharge

The doors to the bankruptcy court are always open to debtors whose discharge is being ignored. And at the end of the day, prove your case and the collector pays your attorney’s fees.

How much more than your attorneys’ fees you recover depends on your ability to show how the discharge violation hurt you.

- Lose sleep

- Get turned down for a loan

- End up in the doctor’s office

- Take a credit report hit

- Feel helpless and hounded

Those are just some examples of the damages you might experience.

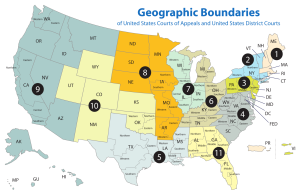

The discharge is enforced by motion here in the 9th Circuit, which means you can get a hearing before the judge much faster than if you’d filed an adversary complaint.

The motion is a contested matter under bankruptcy rules. That entitles you to discovery from the other side if you want or need it.

Most motions are heard and decided on the written pleadings and declarations. Nothing prevents a bankruptcy judge from taking live testimony.

You can enforce the discharge

Stop suffering in silence.

If creditors who were discharged in your bankruptcy case continue to hound you, do something.

Tell your bankruptcy attorney. Bring in the evidence about your contacts with the creditor.

If your bankruptcy attorney doesn’t handle contested matters, ask for a referral to an attorney who does or shop for a local attorney willing to enforce your rights.

It’s my conviction that until it costs creditors to ignore the discharge, they will continue to do so.

And judges don’t know this is a problem until we tell the story in their courtrooms.

So, make them toe the line or pay for the failure to do so.

Debtors beat big banks in California case

What to do after your bankruptcy discharge

Debts that survive the discharge