My soon-to-be ex threatens to file a bankruptcy tomorrow and get me kicked out of the house.

The frantic voice on the phone wanted to know whether he could do that in California.

Or better, how he could be stopped from upsetting the pending divorce through the bankruptcy courts.

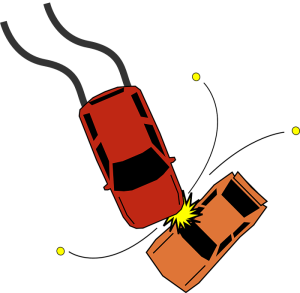

Welcome to the volatile collision between bankruptcy and divorce.

Let’s walk through the bankruptcy law that affects those in the middle of a divorce.

Everyone has the right to file bankruptcy

No one can be ordered not to file bankruptcy.

Bankruptcy relief is a right under federal law. No state court can prevent someone from filing; no agreement to refrain from filing is enforceable.

Interested parties can police the debtor’s compliance with bankruptcy law, with an eye to pushing the debtor out of bankruptcy or into a reorganization chapter, but they can’t prevent a bankruptcy filing.

All community property comes into bankruptcy

The woman on the phone was right to see that the family home would be sucked into any bankruptcy case her estranged husband filed.

In California, each spouse has an undivided half interest in the community property, but in bankruptcy court, both halves of the community property become property of the estate.

So the family home comes under the jurisdiction and control of the Chapter 7 trustee when a bankruptcy is filed. Nominally, anyway.

Exempt property continues to belong to both spouses

Bankruptcy law allows the person filing bankruptcy to exclude certain kinds of assets and certain modicums of value from the reach of the creditors. The debtor selects the assets to be claimed exempt.

The non filing spouse continues to have an ownership interest in the exempt property. A family court can divide that exempt property between the spouses at a later date.

California law requires protection of family home

Bankruptcy debtors in California have the choice of two different systems of exemptions. One features robust protection of equity in a home. That homestead exemption might be as much as $624,000, depending on where the home is located.

The other system has an exemption that can be applied to any kind of assets up to a value of about $30,00.

State law allows a debtor to bypass protection for the family home only with the consent of the non filing spouse. So, an out-spouse can’t choose to protect assets other than the family home unless the other spouse agrees.

Right to support is unchanged

Child support, spousal support, or family support: whatever it is called, bankruptcy does not discharge it. Further, support owed at the filing of the case gets payment ahead of any other creditor.

More about family support in bankruptcy

A discharge in bankruptcy may in fact eliminate other debts that a paying spouse has, facilitating payment of support.

After a bankruptcy, family courts remain free to adjust support orders in light of the changes in the spouses’ finances wrought by the bankruptcy.

Most Chapter 7 cases sell none of debtor’s assets

While a liquidating form of bankruptcy seems horrifying to the spouse who gets blindsided, it may not result in any loss of assets.

Bankruptcy trustees gather up and sell assets only when there is a meaningful net return as a result. Most everyday used “stuff” has so little value that it’s not worth selling.

And trustees have to pay the debtor any exemption the debtor’s claimed in those assets before there’s anything for creditors.

Well more than 95% of individual Chapter 7 cases are “no-asset”, that is, the trustee administers nothing.

All of the debtor’s assets remain the debtor’s assets.

Interests of creditors come ahead of owners

As I thought through what comfort I could provide for the woman threatened with her spouse’s bankruptcy, which wasn’t very much, this last principle of bankruptcy law hit me.

The interests of the creditors of the former marital couple come ahead of the interests of the spouses. The law protects the right to support, and the idea that creditors can’t take everything from a debtor.

But in the tussle for who gets the non exempt value the couple has accumulated, filing a bankruptcy vaults the interests of creditors ahead of those of the spouses.

Payment of the debts of the marriage may benefit the non filing spouse. Or it may not, depending on who the creditors are and which spouse is personally liable for the debts.

The threat to file bankruptcy

In the case that started me thinking about this issue, the threat to file bankruptcy was empty. The husband managed to frighten his wife with his threat, but he didn’t file bankruptcy.

More

Action plan if STBX files bankruptcy

Image courtesy Pixabay.