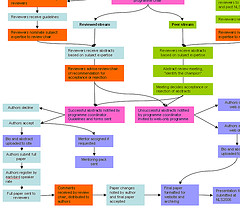

I coined a new rule about asset protection schemes after meeting with a bankruptcy prospect: If the asset protection plan is too complicated for the owner to explain, it probably won’t stand up to challenge. This man had paid an attorney a fistful of money to create LLC’s and limited partnerships, each of which held fractional […]

When Is Individual Business Owner Liable for California Sales Tax

Even when corporate retailers collect California sales taxes from customers, the individuals running the entity face liability for that debt. That’s because, , if the business doesn’t pay, state law allows collection from the business owners themselves The rules are complicated and the results can be harsh if the business falls behind. So business people […]

New California Homestead In Action

The California homestead increase effective January, 2021brought the homestead closer into line with the cost of a home in the Golden State. It’s a change for the better. But how will the change impact the balance of homestead law? Time, or further legislation, will tell. The newly enacted version of California Code of Civil Procedure […]

The Kind of Person Who Files Bankruptcy

You’d think the person who files bankruptcy is some alien fraudster, to listen to my clients. This is last place I ever expected to be, says the client sitting in my bankruptcy office. I hear that probably twice a week. Or, the client assures me: I’m not the kind of person who doesn’t pay their […]

The Biggest Lie About Bankruptcy

The claim that you lose everything in bankruptcy is, flat out, the biggest lie about bankruptcy. Read anything about Chapter 7 and you get, “Your possessions are sold in Chapter 7 bankruptcy.“ It’s a liquidation proceeding and your stuff will be sold to pay creditors, the lie goes on. No wonder people are scared off […]

Your Right To Credit Reporting After Bankruptcy

You’ve finished your Chapter 13 and emerged from bankruptcy with your home loan current. But your credit report is a blank page as to your mortgage. The mortgage servicer isn’t reporting your payments to the credit reporting agencies [CRA’s]. Nothing. Nada. Crickets. So, even though you’re making regular payments, you’re not visibly rebuilding your credit. […]

“Hold Harmless” Survives “To Have and To Hold”

Divorce usually requires the division of the debts of the marriage along with the assets. The legalese usually requires each party to indemnify and hold harmless the other from the debts assigned to that party. Most folks skim over that provision to worry about the division of assets or support issues or the termination of […]

Dumbest Thing For Those In Debt

The headline was compelling: The 5 Dumbest Things You Can Do If You Have Too Much Debt. I even liked the site’s name: How Life Works. That’s a tagline I’d like to use. I could make my own list of dumb ways to tackle debt, but better if someone else had already done it. Until […]

More Californians Eligible For Expanded Pandemic Mortgage Relief Grants

Need help with your California house payments due to COVID? Grants from California’s mortgage relief fund are now available to cover delinquent property taxes and defaults on second mortgages. The expanded eligibility includes those who have previously received grants. Almost $700 million remains in the fund, created in 2021, to preserve homeownership from the ravages […]

Is There Life After Bankruptcy?

Is bankruptcy worth it? If you see filing bankruptcy to get a fresh start as painful or less than honorable, you might wonder what life is like, on the other side of bankruptcy. What’s the return on taking the big step? I got a report from the other side this week from a Chapter 7 […]

- « Previous Page

- 1

- …

- 15

- 16

- 17

- 18

- 19

- …

- 71

- Next Page »