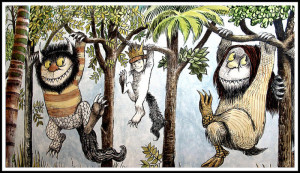

I miss Maurice Sendak, the late author of children’s books. What does a book about a naughty child who adventures in a nighttime land of monsters have to do with being scared of bankruptcy? The last image in his signature book, Where The Wild Things Are, is my touchpiece for clients afraid to file bankruptcy. […]

Bankruptcy Disclosure: Don’t Let Orange Be The New Black

How will anyone know? That’s the question clients ask about assets that they don’t want to disclose on their bankruptcy schedules. Clients are usually afraid of losing the property or of involving family and friends with the bankruptcy court. They really just want to fly under the radar in their social circles. Why do we […]

Free Tax Preparation Offered In Bay Area

Households with an annual income of $54,000 or less can have their tax returns prepared for free through the Bay Area United Way’s Earn It, Keep It, Save It program. Earned Income Tax Credit The Earn It, Keep It, Save It campaign is particularly focused on enabling qualifying individuals and families to access this tax […]

Turned Down For A Bank Account? Fight Back

Turned down when you tried to open a bank account? We have a clue why. We all know the big three credit reporting agencies: Experian, TransUnion, and Equifax. But if you’ve been turned down for a bank account, you need to meet the other players in this space: the checking account screening companies. Certegy ChexSystems […]

What’s Included In Bankruptcy?

People ask, all the time, what’s included in bankruptcy? What do I list in my bankruptcy paperwork? Think of it like this: bankruptcy is a snapshot of your situation on the day the bankruptcy case is filed. Maybe, you think of your bankruptcy like the Clampett’s Buick, arriving in Beverly Hills, crating all their stuff. […]

List It Or Lose It: Why It’s Critical To Tell All

It is vital to include everything in your bankruptcy list of assets. Transparency is the essential ingredient in bankruptcy. The name of the game is disclosure. In exchange for that full disclosure in your bankruptcy papers of assets , debts, and financial history, you get a discharge. Do it right, everyone with notice of your […]

Right To Support When Your Ex Files Bankruptcy

Outrage is the usual reaction when a former spouse with child support or alimony files bankruptcy. It reinforces all those less-than-flattering thoughts you harbor about your ex. But,maybe, that’s not the right reaction for two reasons, one old, one new. One is old: support debts can’t be wiped out in bankruptcy. The second reason is new: failure […]

Debt Collectors Distort Law On Debts Of Spouses

Debt collectors claim you are personally liable for your spouse’s, debts. Or even for your ex-spouse’s debts. That’s a (convenient) lie. California community property law is complicated. I get it. It shouldn’t surprise me that debt collectors don’t understand community property. Or maybe, they find it inconvenient to understand. Or maybe, they deliberately distort the […]

Automatic Stay Has Exceptions: It Doesn’t Stop Everything

The automatic stay is the signature feature of American bankruptcy, but the stay has important exceptions. Just by filing a bankruptcy case, a federal court injunction instantly prohibits your creditors from actions to collect a debt from you or your assets. But, there’s a whole list of actions that aren’t included in the stay. We […]

What’s Wrong With Most Get-Out-Of-Debt Advice

Get-out-of-debt gurus too often miss the essential truth known to every carpenter. Measure twice, cut once Too many trite lists of tips to help you get out of debt miss the vital first step: understand the situation fully. How you got into debt Before you choose a get-out-of-debt path, understand where you’ve come from. Until […]

- « Previous Page

- 1

- …

- 30

- 31

- 32

- 33

- 34

- …

- 71

- Next Page »