The wait is over; the decision is in. Homeowners in the 9th Circuit can strip off underwater mortgages in Chapter 13 cases even when they aren’t entitled to a bankruptcy discharge, the 9th Circuit BAP has held. Thus, courts have taken another step in the building consensus that the debtor doesn’t have to be eligible […]

Homeowner Beats Loan Servicer On Foreclosure Appeal

California appeals court slaps down servicer’s attempt to require payment of the entire mortgage loan a condition of homeowner protection. Nice try, Ocwen. But no, says an intermediate California appeals court. Such an interpretation would gut the California Homeowner’s Bill of Rights. Facing foreclosure The facts in Valbuena v. Ocwen are common: Ocwen became the servicer […]

Why No-Look Bankruptcy Fees Are No-Good

Lawyers become lawyers, in large part, because they can’t, or don’t want to, do math. Judges are lawyers who got promoted. And therein is the root of the problem with “no look” attorneys fee for consumer bankruptcy cases. Judges don’t understand mathematics. They expect the “law” of averages to result in fair compensation for debtor’s lawyers, relieving judges […]

Time Running Out To Claim Prior Year Tax Breaks

Time is running out on your 2011 tax return. Whaaaat?, you say. You’re working on 2014 between now and April 15th. But if you’re one of those people who overlooked a tax deduction or, better yet, a tax credit like EITC, you’re running out of time to amend your 2011 return and capture some of that money. An […]

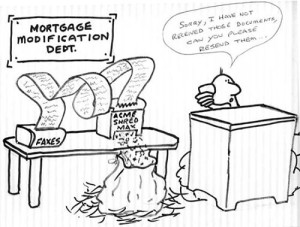

Loan Modification Excuses No Longer Good With Courts

Some excuses never seem to wear out. There seems to be no limit to the number of times a mortgage loan servicer can claim they haven’t received all the documents they need. Then, they base their denial of a loan modification on the borrower’s lack of responsiveness. Whether your mental image of the problem […]

Why Tax Software Is Lousy Purchase

Why pay for Turbo Tax or its competitors when, odds are, you can get it for free? Unless you like burning money. Seventy percent of American taxpayers qualify for free tax software. If your income was $62,000 last year or less, you can use commercial tax filing software for free through the IRS FreeFile program. […]

My 7 Favorite Soapbox Posts Of 2014

I tallied the readership’s favorite posts of the year and found the list far different than mine. So here’s the counter-list of my favorite posts of 2014, drawn from material first published this year. Most impactful appellate decision Welsh was decided in 2013, but I talked about it on Soapbox in 2014: The Most Important […]

Best Of 2014 On Bankruptcy Soapbox

Here are the ten posts that most intrigued readers of Bankruptcy Soapbox in 2014. Some are new this year, and others are classics from earlier. In reverse order, the ten posts that spoke to you. 10. Six Rotten Reasons Not To File Bankruptcy Mortgage law attorney Bill Purdy walks through the misguided reasons his clients […]

Zombie Debt is Naughty, Not Nice

Despite his bankruptcy discharge, my former bankruptcy client has just been bitten by naughty credit reporting, and the interim results aren’t nice. When several years passed since the bankruptcy, my client thought he’d caught and controlled the old and the inaccurate credit reporting. Four years after the discharge was entered, a mortgage servicer has just […]

When Stagnant Home Values Mean Huge Savings

I thought the lien stripping ship had sailed. We are finally climbing out of the worst of the Great Recession and California real estate values are recovering. Turns out, I was wrong. It’s not too late to reduce your mortgage debt by tens, or even hundreds of thousands of dollars, if you live where real […]

- « Previous Page

- 1

- …

- 57

- 58

- 59

- 60

- 61

- …

- 71

- Next Page »