I watched dozens of Chapter 13 bankruptcy cases get dismissed in a single afternoon in court recently. Dismissed. Tossed out. Ended. The usual reason was that the debtor had not taken seriously the requirement that all their tax returns be filed within 45 days of the commencement of the case. Regardless of the debtor’s need […]

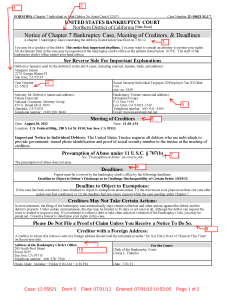

Ten Essential Nuggets For Creditors in Bankruptcy Notice

You’re looking at bankruptcy official form B9. It arrived in your mail because someone has filed bankruptcy and listed you as a creditor on the schedules of a newly filed bankruptcy case. Most likely, the debtor owes you money or you have an open claim of some sort against the bankrupt. Your rights against the debtor […]

Will A Second Bankruptcy Really Protect?

Immediate protection from collection is at the top of the list for most bankruptcy filers. They want the lawsuit to stop; the wage garnishment to stop; the debt collectors to stop. But, if this isn’t your first bankruptcy case, do you get that protection? What the automatic stay does The Automatic Stay (or “Stay”) protects […]

When Chapter 20 Bankruptcy Adds Up

You can look a long time in the Bankruptcy Code without finding Chapter 20. Chapter 7 is there; so are Chapters 11 and 13. But no 20. But you find it in bankruptcy courtrooms and in the arsenal of good bankruptcy lawyers. So, what’s up? Chapter 20 is really bankruptcy slang. It’s a Chapter 7 case […]

Warning: Wells Fargo Can Freeze Your Account

Preparation for filing bankruptcy should include getting your money out of Wells Fargo Bank. Unless, of course, you’re willing to have Wells freeze your money for days or weeks, on its own initiative. Wells says they are “helping” the bankruptcy trustee by denying you access to your money. Only the bankruptcy trustee didn’t ask for […]

Are You Stuck With The Lawyer Who Filed Your Bankruptcy Case?

Your bankruptcy case is filed. It’s not going as smoothly as you expected. In fact, you’re worried you’re going under. Can you change bankruptcy lawyers after your case is filed? Certainly, you can always fire your lawyer. It may be disruptive. It will certainly cost more money. To decide you need to know So, how […]

Who’s Afraid Of Bankruptcy’s 90 Day Rule

Most folks considering bankruptcy know about the 90 day rule in bankruptcy. They’ve talked to friends or read on the internet. When they get to a bankruptcy lawyer’s office, they’re eager to tell me they know about the rule, though sometimes they have questions about just how it works. Which is all very interesting, except that […]

Bankruptcy Alphabet: T is for Tension

In my bankruptcy alphabet, T stands for Tension. I’m not talking so much about the tension the person filing bankruptcy feels, though that is real and not to be discounted. I’m talking about the tension in the law that balances the interests of creditors with the interests of debtors. Bankruptcy law in the US recognizes […]

The Government Loans That Bankruptcy Wipes Out

Believe it or not, certain unsecured loans from government entities are dischargeable in bankruptcy. This includes SBA loans, and loans made through The Department of Veteran’s Affairs (VA), Department of Housing and Urban Development (HUD) and others. That’s the good news. What is CAIVRS and How is it a Problem? The bad news is that […]

Bankruptcy Alphabet: D is for Discharge

“D” is for discharge in my bankruptcy alphabet. Getting a discharge of debts is the goal of most bankruptcies. The discharge is the court order, issued at the conclusion of a case, that wipes out the filer’s personal liability for most debts that existed when he began the case. Not everything is discharged. The Bankruptcy […]

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- Next Page »