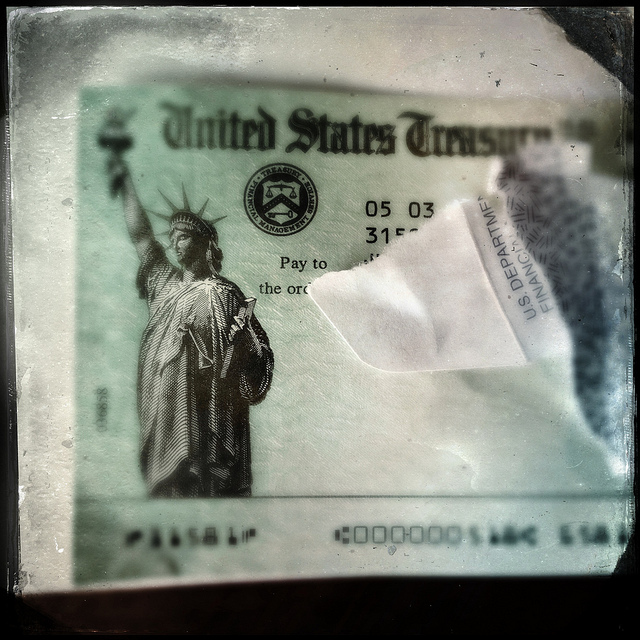

Getting a tax refund check from the government is usually a great thing.

Or at least, if you ignore that the government is returning YOUR money as a tax refund. You’ve struggled without the money for a year while Uncle Sam used it without interest.

But if you’ve filed bankruptcy during the tax year, the bankruptcy trustee may demand you turn over of a portion of the refund as having accrued before you filed bankruptcy.

Ouch! You lose twice.

Cut your creditors out of your tax refund

Part of your pre bankruptcy planning should include a look at your current year withholding.

If you usually get a substantial refund, or if something in your tax life suggests you’ll get a big refund for the year you file bankruptcy, do something!

The trustee can demand a portion of the refund only if there IS a refund.

Decrease your withholding as soon as you decide to file bankruptcy such that your reduced withholding for the last part of the year brings you close to the amount you expect to owe.

How to plan for no refund

To take a simple example, assume that your total income tax is $6000, and you usually get a $6000 refund when you file your taxes. That means that each month, you are overpaying Uncle Sam by $500 (12 x $500= $6000).

If you decide to file bankruptcy at mid year, you will already have paid all you expect to owe in taxes for the tax year. (You usually pay in $12,000, and get $6000 back). Don’t withhold any more.

Come next spring when you file your return, there won’t be a refund, and the bankruptcy trustee can pound sand.

I’ve used nice round numbers and easy fractions to illustrate my point. Get out your calculator and figure what your annual total tax is, and what you’ve paid in to date to find the right numbers, and the right withholding for your situation going forward.

Or, get help from your tax preparer.

Make better use of your money

My hope is that you’ve diverted that $500 a month that you used to lend to Uncle Sam for the year to funding your retirement or creating an emergency fund.

After all, one of the best reasons to file bankruptcy is to eliminate debt and set money aside so you can be financially self sufficient.

More on planning for bankruptcy

How to spend money before you file

Don’t make big changes before getting legal help

How to interview a bankruptcy lawyer

Image courtesy of Flickr and Seth Anderson.