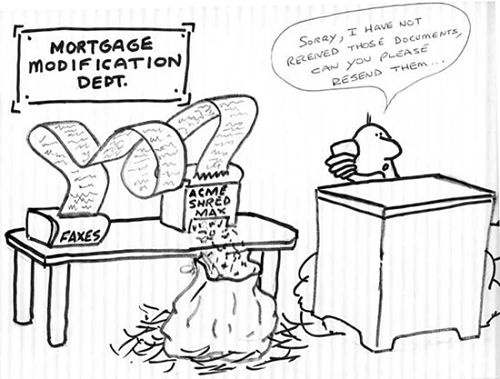

Some excuses never seem to wear out.

There seems to be no limit to the number of times a mortgage loan servicer can claim they haven’t received all the documents they need.

Then, they base their denial of a loan modification on the borrower’s lack of responsiveness.

Whether your mental image of the problem is caught in this cartoon, or whether you image the last scene from Raiders of the Lost Ark, where the precious tablets are dutifully stored away and forgotten in a government warehouse, the problem is the same:

Loan servicers assume no responsibility for the manner in which they handle, or mangle, loan modification applications.

The tide is turning.

Not that lenders have learned to handle paper. I’ve seen no evidence of that.

Courts reject servicer defenses

But courts are losing patience with the “dog ate my homework” excuse for why borrowers were denied a modification or why they violated the California Homeowners Bill of Rights.

Most recently, federal judge Claudia Wilken (N.D. CA) ruled that servicers have legal duties to the borrower when they offer loan modifications.

A breach of that duty can result in a right to damages.

Writing in Gilmore_v._Wells Fargo, Judge Wilken held that

Wells Fargo owed [the homeowner] a duty to process his loan modification with reasonable care. The loan modification application process was intended to affect Plaintiff. It was foreseeable that harm would occur to Plaintiff if his loan modification materials and application were not properly routed. Wells Fargo knew, with certainty, that if Plaintiff’s application was not properly handled, he would not receive a modification and, thus, would lose his home.

In upholding a common law duty of care on the part of the servicer, Judge Wilken moved beyond the protections offered by California’s Homeowner’s Bill of Rights, which by statute prohibited dual tracking, where servicers simultaneously entertained a loan modification application while proceeding toward foreclosure.

Lack of caring may cost the banks

I’m delighted that the judiciary has finally called the banks on their utter indifference to their borrowers. They care not that they almost brought the nation’s economy to its knees in the Great Recession; then they hold out the prospect of a loan modification, to temper the consequences of their misdeeds, while really crossing their fingers behind their backs.

The Gilmore decision is one of a number of decisions holding that a mortgage servicer has responsibilities in the conduct of a loan modification program; other cases deny any such duty. Prof. Dan Schechter of Loyola Law School predicts we will see a 9th Circuit decision telling us which approach is the law here in California.

The California Homeowners Bill of Rights Collaborative has a practice guide for litigating HBOR claims.