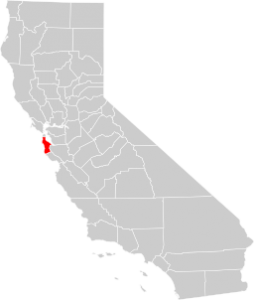

Care to guess what it will cost a retired couple in San Mateo County to meet their basic living needs?

Care to guess what it will cost a retired couple in San Mateo County to meet their basic living needs?

If they rent, it takes $3193 a month.

If they have a mortgage, it rises to $4247.

Those dollars cover housing, food, medical, transportation and $376 for everything else.

Social security doesn’t cut it

The average Social Security payment is $1341 per month.

The maximum Social Security benefit in 2016 for someone at full retirement age is $2639.

If Social Security is all you have for retirement, there’s a problem.

The gap ranges from $660 a month for the couple with one maximum Social Security benefit check and a rented apartment.

The gap widens to $3204 for the couple with median Social Security income and a mortgage to pay in retirement.

Homeownership helps some

If our retiring couple own their home outright, they are a bit closer to a balanced budget. They will need $2254 per month to meet basic needs.

A fully paid for house of course represents a further retirement asset. But that home equity is useable only upon sale or a reverse mortgage.

Aging in place

The Center for Community Economic Development has an interactive calculator for the cost of independent retirement living by California county from which I took these figures.

If you live elsewhere, you can see the numbers for your locale. You can also see what it would cost to retire somewhere else in California.

If you haven’t reached retirement yet and aim to age in place in San Mateo County, take a look at these numbers and your resources. Give some serious thought to how comfortable retirement will be on your present path.

If the numbers make you wince, start putting money away for old age today.

Between now and April 15th, you can make an IRA contribution for both last year and this year.

Do it. Your older self will applaud.

Image courtesy of Wikipedia and Thadius856.