Isn’t my case over?

I got my discharge. Why’s the bankruptcy trustee still hounding me?, my client asks.

People who’ve filed bankruptcy are focused on the discharge as their goal.

With their discharge in hand, they think it’s all over.

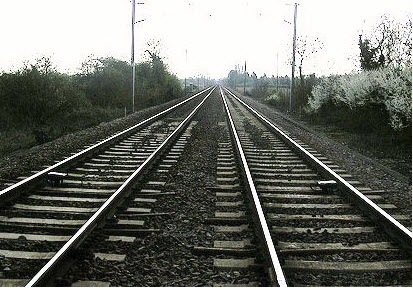

They lose sight of the fact that the administration of a bankruptcy estate by the trustee runs on a parallel track to the one that leads the debtor to a discharge.

Different tracks. Different timelines.

Trustee’s job

The Chapter 7 trustee’s job doesn’t necessarily end at the 341 meeting where the debtor appears and answers questions.

Most Chapter 7 cases end for the trustee with the first meeting of creditors. There are no assets for the trustee to administer and no unanswered questions.

But the trustee may have responsibilities that remain after the meeting.

The trustee is charged with investigating the debtor’s right to a discharge and with turning any nonexempt assets of the debtor into cash for benefit of creditors.

The trustee may need to know about bank balances on the date of filing or transfers that he may be able to recover.

If he has assets to distribute, he needs to review the claims filed by creditors. If the bankruptcy estate has income, he may need to file a tax return.

There can be lots of work for the trustee in an asset bankruptcy case.

Road to discharge

For the debtor, the track is usually far shorter.

The Bankruptcy Code was structured to let the debtor know very quickly after the filing of the case whether he will get a discharge.

Or rather, it’s set up to let the debtor know whether there’s a dispute about getting a bankruptcy discharge or about the dischargeability of a particular debt.

The notice that goes out to creditors right after a bankruptcy case is filed sets out the deadline for creditors to challenge the discharge or the dischargeability of a particular debt. That date is usually 60 days after the date of the first meeting of creditors.

Anyone challenging the discharge must file an adversary proceeding with the bankruptcy court in that time.

Absent the filing of an adversary, the court issues the discharge. The debtor heaves a sigh of relief and thinks it’s all over.

Trustee work continues

The trustee’s work is not ended just because the debtor got a discharge.

If there are assets, he’s still got work to do. He may need information or other forms of cooperation from the debtor to do his job as trustee.

The debtor’s failure to provide that cooperation can lead to an action to revoke the discharge. So the debtor still has some skin in that game.

The administration of some bankruptcy estates goes on for years. It all depends on the nature of the assets the trustee is administering.

No asset cases

The vast majority of bankruptcy cases are no-asset cases.

That’s a shorthand way to say that there are no assets for the trustee to administer and there will be no distribution to creditors. Even though Chapter 7 is termed a liquidation proceeding, there may be nothing of value worth liquidating.

In those cases, the trustee may file his no-asset report and close his file long before the debtor gets the discharge.

So the trustee and the debtor proceed down the tracks of a bankruptcy case, in parallel, but not intersecting.

More

The stuff you keep: exemptions

Choosing between the bankruptcy chapters

Making the most of your bankruptcy discharge

Image courtesy of Flickr and Anna L. Martin.